Issue Contents:

Model Performance Under the Marketing Rule

By: Lance C. Dial

From time to time, an investment adviser may have a strategy, but with no clients. The adviser may, nonetheless, manage that strategy on paper, as a model, recording transactions that would have been made in client accounts at the time the adviser would have made those recommendations. In this way, an adviser can develop a history for this model as well as a performance track record, i.e., model performance.

Model performance, such as the above, can be useful to investors. Therefore, in adopting the overhauled Rule 206(4)-1 under the Investment Advisers Act of 1940, as amended (the “Marketing Rule”), the Securities and Exchange Commission (“SEC”) permitted advisers to include model performance in advertisements, but considered it to be a type of “hypothetical performance” that is subject to certain conditions on its use.

Since the effective date of the Marketing Rule back on May 4, 2021, the SEC has focused intently on the use of hypothetical performance in investment adviser advertising, bringing 18 enforcement actions relating its use. Of those 18, 13 actions involved the use of model performance, or, in the words of the settlements, “hypothetical performance that consisted of performance derived from model portfolios.” So, while advisers are permitted to create model performance and use it in advertisements, they should take great care to ensure compliance with the requirements concerning the use of hypothetical performance.

So, what is this “model performance,” and why is it such a focus of the SEC?

In general, model performance includes any performance that is generated other than through managing actual client accounts. Most commonly, model performance reflects the returns of a “paper portfolio” (i.e., investment recommendations that would have been recommended to client accounts) where no assets are actually managed pursuant to the recommendations. Such performance is considered model performance even if the adviser (or another party) implements the recommendations of the model, subject to any specific client restrictions. In the view of the SEC, this performance remains hypothetical because it represents performance results that were not actually achieved by any portfolio.

This performance can be distinguished from situations where a client account (i.e., a primary account) is managed in a certain strategy, and other accounts are managed to match its investments (i.e., clone accounts). In this scenario, the performance of the primary account is not considered model performance because an actual account is managed in that strategy.

As noted above, model performance is permitted under the Marketing Rule, subject to certain conditions. Primary among those conditions is the requirement that the adviser adopt policies and procedures reasonably designed to ensure that the model performance is “relevant to the likely financial situation and investment objectives of the intended audience.” In practice, this means that advertisements with model performance should not be publicly disseminated, but instead their distribution should be limited to an audience the adviser believes to be capable of understanding the risks and limitations of the model performance. In fact, it is this requirement that the SEC found advisers to have breached in the recent settlements finding that advisers distributed model performance to a mass audience (typically through the firm’s website) rather than limiting its distribution as required under the Marketing Rule.

The Marketing Rule also includes other conditions, specifically that model performance include disclosures of the criteria and assumptions used in creating the model performance and the risks and limitations of a potential investor relying on it to make a decision whether or not to hire the adviser.

One additional condition is that model performance must be presented net of fees. Given that model performance is, by definition, based on investment recommendations that are not implemented for a client account, there is not necessarily an actual fee than can be used to calculate net performance. The Marketing Rule addresses this by permitting the deduction of a model fee, which, in general, must be the highest fee that would be charged to the intended audience.

In conclusion, model performance can be a powerful tool for advisers to market their services to clients and potential clients; however, the use of model performance is subject to provisions of the Marketing Rule, and the SEC is paying close attention to compliance. As a result, advisers who advertise model performance are well-advised to look closely at their policies, procedures, and practices (e.g., not permitting model performance on a public website) to ensure they are in compliance with the Marketing Rule.

Special thanks to Lance C. Dial, Partner, K&L Gates for submitting this article.

Have an opinion? Please share it with Patrick Fowler.

Quote of the Month

“It is what we know already that often prevents us from learning.”

– Claude Bernard

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “Performance Analytics Technology” by Alex Shafran, CFA; Ian Thompson, Ph.D.; and Shankar Venkatraman, CFA, FRM, which was published in the Summer 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

The objective of this article is to explore the evolution of performance systems and how they can help performance professionals maximize their use of technology. By examining key aspects such as solution ownership, the scope of change, possible operating models, and necessary skills, the article aims to provide insights into how performance teams can utilize technology to address requirements such as compressed timelines, precision, transparency, and distribution of performance information to all stakeholders both within and outside their firm. The reader is encouraged to consider the questions posed throughout the article through the lens of their own experience with technology and to ask their own questions as they continue to advance in their performance career.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

Attention: TSG Verification Clients Attending the 28th Annual GIPS Conference

TSG will host a dinner on September 17th for clients and invited guests. Please email Chris Spaulding if you are interested in joining us. CSpaulding@TSGperformance.com

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Agendas Announced for Fall Meetings of

The Performance Measurement Forum

November 7-8, 2024 – Barcelona, Spain (In-person/Hybrid option)

November 21-22, 2024 – Charleston, SC (In-person/Hybrid option)

The Performance Measurement Forum has met 105 times over the past 25 years, and our next meetings are scheduled for November in Barcelona, Spain and Charleston, SC.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

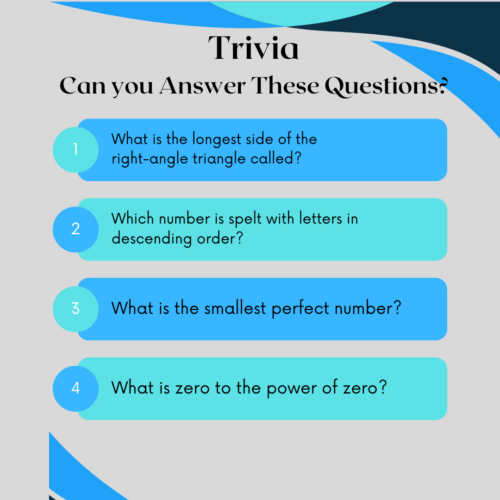

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Submit your responses to: PFowler@TSGpeformance.com

Please submit your trivia solution or puzzle ideas to Patrick Fowler.

Book Review

My Thoughts, by Montesquieu

Review by David D. Spaulding, DPS, CIPM

As with many of the books I read, to recall why I chose this it would be a challenge. Perhaps I stumbled upon the name, Montesquieu, in a book or article, recalled it, and thought it would be worthwhile to gain some exposure to him. And what greater exposure than to delve into his very thoughts. The book was originally written in French, with the understandable title Mes Pensées. His thoughts are numbered (there are 2,266 of them). And not surprisingly, it’s a rather substantial text: 678 pages.

The author’s real name was Charles-Louis de Secondat, Baron of La Bréde and of Montesquieu. He lived from 1689 to 1755. At some point, he decided to commit his thoughts to paper. One might see them as a bit of rambling, as they are not grouped in any logical or categorial way. Are our thoughts? He often returns to subjects, but this may occur many pages later.

As often happens, I found some gems that could be incorporated into various content I craft. For example, his “It seems we owe the tribute to the memory of so many learned men” is making its entry into the Performance Fundamentals class I teach, while De lis quae falso creduntur (“On those things that are wrongly believed”) will be the subject of an upcoming article.

Montesquieu’s thoughts should cause the reader to think, too. There are things I agree with, some I disagree with, and many I never thought about.

While I’ve been journaling, off-and-on [mostly off these past few years], for decades, the idea of simply writing my thoughts down never occurred to me.

This is one of those books one can pick up at their leisure, whenever, read a few pages, and put it back down, without losing one’s place. You could go through it randomly, if you wanted, though I think it best to read from the start to the finish.

I am only part way through, but am comfortable suggesting you obtain a copy and read it. I think you’ll enjoy it as I am.

Model Performance Under the Marketing Rule

By: Lance C. Dial

From time to time, an investment adviser may have a strategy, but with no clients. The adviser may, nonetheless, manage that strategy on paper, as a model, recording transactions that would have been made in client accounts at the time the adviser would have made those recommendations. In this way, an adviser can develop a history for this model as well as a performance track record, i.e., model performance.

Model performance, such as the above, can be useful to investors. Therefore, in adopting the overhauled Rule 206(4)-1 under the Investment Advisers Act of 1940, as amended (the “Marketing Rule”), the Securities and Exchange Commission (“SEC”) permitted advisers to include model performance in advertisements, but considered it to be a type of “hypothetical performance” that is subject to certain conditions on its use.

Since the effective date of the Marketing Rule back on May 4, 2021, the SEC has focused intently on the use of hypothetical performance in investment adviser advertising, bringing 18 enforcement actions relating its use. Of those 18, 13 actions involved the use of model performance, or, in the words of the settlements, “hypothetical performance that consisted of performance derived from model portfolios.” So, while advisers are permitted to create model performance and use it in advertisements, they should take great care to ensure compliance with the requirements concerning the use of hypothetical performance.

So, what is this “model performance,” and why is it such a focus of the SEC?

In general, model performance includes any performance that is generated other than through managing actual client accounts. Most commonly, model performance reflects the returns of a “paper portfolio” (i.e., investment recommendations that would have been recommended to client accounts) where no assets are actually managed pursuant to the recommendations. Such performance is considered model performance even if the adviser (or another party) implements the recommendations of the model, subject to any specific client restrictions. In the view of the SEC, this performance remains hypothetical because it represents performance results that were not actually achieved by any portfolio.

This performance can be distinguished from situations where a client account (i.e., a primary account) is managed in a certain strategy, and other accounts are managed to match its investments (i.e., clone accounts). In this scenario, the performance of the primary account is not considered model performance because an actual account is managed in that strategy.

As noted above, model performance is permitted under the Marketing Rule, subject to certain conditions. Primary among those conditions is the requirement that the adviser adopt policies and procedures reasonably designed to ensure that the model performance is “relevant to the likely financial situation and investment objectives of the intended audience.” In practice, this means that advertisements with model performance should not be publicly disseminated, but instead their distribution should be limited to an audience the adviser believes to be capable of understanding the risks and limitations of the model performance. In fact, it is this requirement that the SEC found advisers to have breached in the recent settlements finding that advisers distributed model performance to a mass audience (typically through the firm’s website) rather than limiting its distribution as required under the Marketing Rule.

The Marketing Rule also includes other conditions, specifically that model performance include disclosures of the criteria and assumptions used in creating the model performance and the risks and limitations of a potential investor relying on it to make a decision whether or not to hire the adviser.

One additional condition is that model performance must be presented net of fees. Given that model performance is, by definition, based on investment recommendations that are not implemented for a client account, there is not necessarily an actual fee than can be used to calculate net performance. The Marketing Rule addresses this by permitting the deduction of a model fee, which, in general, must be the highest fee that would be charged to the intended audience.

In conclusion, model performance can be a powerful tool for advisers to market their services to clients and potential clients; however, the use of model performance is subject to provisions of the Marketing Rule, and the SEC is paying close attention to compliance. As a result, advisers who advertise model performance are well-advised to look closely at their policies, procedures, and practices (e.g., not permitting model performance on a public website) to ensure they are in compliance with the Marketing Rule.

Special thanks to Lance C. Dial, Partner, K&L Gates for submitting this article.

Have an opinion? Please share it with Patrick Fowler.

Industry Dates and Conferences

- September 25 – London Performance and Risk Summit

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events,

please contact Patrick Fowler at 732-873-5700.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Question 9: Do you agree that the effective date should be 12 months after the issue date?

Ideally, CFA Institute would provide more time for implementing the guidance. We would recommend a longer time frame, e.g. 18 months. However, we believe 12 months would be the minimum that firms that already claim compliance with the GIPS standards would need to implement any necessary changes.

That’s a Good Question

Question:

Dear Gary Brinson,

I’m curious about the two attribution models you wrote about, in both the JPM piece w/ Fachler in 1985 and the FAJ piece in 1986 with Hood and Beebower. Did you and your co-authors craft them yourselves, or did you learn of them from another source? And, if from another source, I’d like to know, if possible, what that was.

I recently learned of an article from 1975 that appeared in The Journal of the Institute of Actuaries in the UK. On page 270, there’s a description of both methods, with the only difference being the use of the portfolio’s sector returns for selection, rather than the benchmark’s (thus avoiding the “other,” “cross-product,” or “interaction” effect). From this, it’s unclear what the original source was, though it seems to hint at Investment Analyst, another UK publication. Both of these are defunct.

I would understand if you and your colleagues crafted the formulas independently, as this has been known to happen [the most famous example perhaps being calculus, which both Leibniz and Newton have been credited with creating]. I believe your chief aim in these articles was to argue that allocation plays a major role in the resulting return, and attribution allowed you to demonstrate this.

The industry has, of course, settled on naming them the BHB and BF methods, and I have no interest in changing that. My interests are principally academic.

Looking forward to whatever you can share. Thanks!

Best wishes,

Dave

Response:

David,

Our articles were developed from the ground up in the early to mid-1980’s. A search of the literature at that time did not reveal any related work, nor did the article you have provided. Someone mentioned such an article to me a couple of decades ago, but could not provide any direct reference. Obviously, thanks to you the article does exist and does seem to contain useful insights into performance measurement and attribution. Thank you for sharing this with me. While our articles were independently developed, it is interesting to have this piece of history.

As the years pass by, I remain ever grateful to you for the ongoing support of investment performance and attribution through your publications and professional development.

Best regards,

Gary P. Brinson

Please submit your questions to Patrick Fowler.

Potpourri

In The News

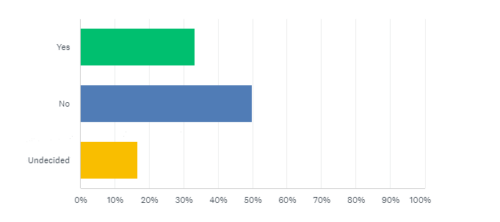

Answers to last month’s survey

Question: Should Pete Rose be in the Baseball Hall of Fame?

Yes: 33.3%

No: 50.0%

Undecided: 16.6%

2. If you believe Pete Rose should be allowed into the Hall of Fame, what are your main reasons?

- He was eligible to be voted upon when he was banned from baseball (which is a separate institution than the HoF/museum itself. The HoF subsequently changed their rules (undoubtedly under pressure from the MLB commissioner). It seems unfair that the ban to which Pete agreed was effectively bait-and-switched on him. I believe he should be banned from the game (coaching/managing or otherwise being affiliated with a team), but his enshrinement in the HoF should at least be allowed to be voted upon.

- Needs an asterisks if so.

3. If you believe Pete Rose should not be allowed into the Hall of Fame, what are your main reasons?

- Betting on baseball. Lying about betting on his own team.

- He violated a fundamental pre-requisite of the game.

- It is about the reason for Baseball’s Rule 21(d). It is about ensuring the integrity of the game. My understanding/recollection was there was evidence Pete Rose bet on the Reds to win games when he was the manager. If he bet the same amount of money every day I could be convinced he didn’t impact the integrity of the game. However, I believe he bet more on certain games than others, which may naturally impact how he would manage the team in a short-sighted way to win games that matter. Therefore, he broke the rule, and there is either real or perceived implications of his wagering on the integrity of the sport.

- Pete knew the rules, and not only violated them, but lied about it, repeatedly. If it were not for his gambling on games, especially involving his own team, he’d be in. That was a huge mistake.

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: January 13, 2025

Spring Issue: March 10, 2025

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.