We’ve been asked by a client to construct a single day, fairly intensive class on rates of return. Much of the material for the class comes from our Fundamentals of Investment Performance class, which we’ve been teaching for nearly 18 years. As you’d expect, plenty of new material has been added. We will add this course to our training program, as we expect others will find a focused rates of return class of value.

We know that there are times when time-weighted rates of return don’t seem to make sense. As a result, some folks actually believe that a characteristic of time-weighted returns is that they’re not supposed to make sense! The reality is, as long as the data is right and the calculations performed correctly, there will always be an explanation. There are times, too, when money-weighted rates of return don’t “make sense,” either. Likewise, there should be an explanation.

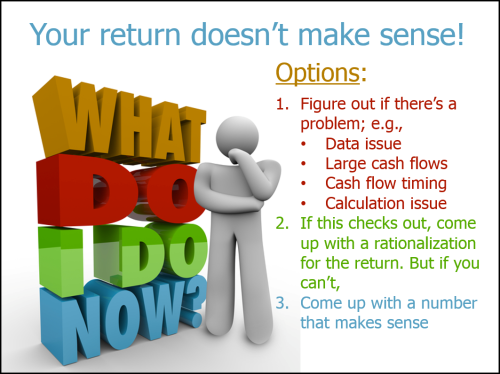

This new rates of return class includes examples of time-weighted rates of return that, at first glance, don’t make sense; some of these examples our taken from our Fundamentals class. I’ve added a section that addresses the challenge of rates of return that are difficult to interpret. I created this slide to demonstrate choices we have, when confronting such returns:

As noted here, when returns don’t seem to make sense, the first thing to do is ensure that your data and processing are correct. If they are, then there should be a way to interpret the result. If you can’t figure it out, I show an option of finding a return that does make sense (i.e., to replace the return that “doesn’t make sense” with one that does).

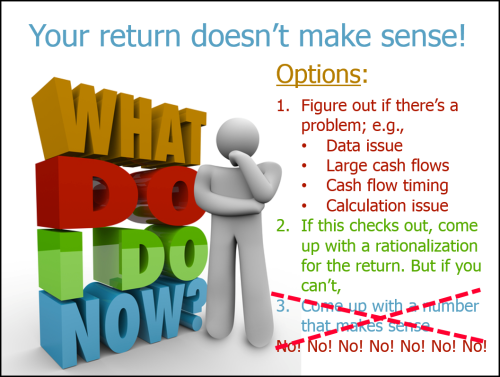

As you might expect, the third point is not one I’m serious about, and I immediately follow up this slide with the following:

I wouldn’t have suggested the third option except that I’ve found systems that actually do just this: if the number doesn’t make sense, they will provide a mechanism to override it with one that does. I think this is amazingly wrong.

I’ll have a bit more to say on this in our March (intentionally delayed but soon to be published) newsletters.