The Global Investment Performance Standards (GIPS(R)) has evolved over the past several years. And some of these changes have been in regards to how to calculate rates of return. Today, revaluing for large cash flows is the minimum GIPS requirement. The reason: accuracy.

If you use Modified Dietz or Modified BAI (aka, the Linked IRR) on a monthly basis, its accuracy diminishes when your portfolio experiences (a) large cash flows and/or (b) market volatility. Let’s face it: the market has been volatile for decades, so that’s a given. And often clients add or remove sizable amounts of cash and/or securities, which can impact performance. Consequently, revaluing for large cash flows is a way to improve accuracy.

At one time, those who control the Standards considered requiring firms to revalue for all cash flows; however, based on the feedback from the public, this was changed to only revaluing for “large” cash flows, where the firm gets to decide what “large” means to them. In general, large is considered flows of 10% or more of the portfolio value, though many firms have lower thresholds (e.g., 5%).

It’s my opinion that revaluing for large flows is significantly more difficult than revaluing for all cash flows. I am saying (actually, writing) this in the context of the logic to employ it, not the process of actually getting the prices and revaluing the portfolio, which, in some cases (e.g., for less liquid bonds) can be a bit of a chore). Consequently, those who revalue for large flows may want to consider switching. Why? Well, let’s consider this a bit.

Revaluing for large cash flows’ challenge: it can be tricky when there are multiple flows in the month

When there are multiple flows, you need to test each one to see if you need to revalue. And, if there are multiple large flows in a month, you’ll revalue multiple times.

But what determines whether a flow is small or large? Consider the following scenario:

- V0 = 100,000

- Value at time of flow = 101,000

- C1 = 20,000;

- Adjusted Value with flow = 121,000

- C2 = 15,000

Your definition of “large” is 10%; therefore, the first flow (20,000) is large, since it is 20% of the starting value (100,000). At the time of the cash flow the portfolio is 101,000, so we know that the return for the period of to the first flow is 1 percent. We next revalue the portfolio for the second period by adding the cash flow (20,000) to the most recent valuation (101,000) to yield 121,000.

We get a second flow of 15,000. Question: is this a small or large flow?

If we compare it to the initial value (100,000) it’s “large.” However, if we compare it to the most recent valuation (121,000), it’s “small.” Which is right?

I believe you should revalue against the most recent value; therefore, the flow is “small.” To calculate the return for the second period, you’d use Modified BAI or Modified Dietz.

Please consider this situation:

- V0 = 100,000

- Value at time of flow = 101,000

- C1 = -20,000

- Adjusted Value with flow = 81,000

- C2 = 9,000

Our definition of “large” is again 10%, meaning that the withdrawal of 20,000 is “large.” The portfolio had risen to 101,000 at the time of the flow, so the revised valuation is 81,000. We get a flow of 9,000. Is it large or small?

If we compare it to the starting value, it’s “small.” However, if we compare it to the most recent valuation, it’s “large.” Again, I favor using the most recent valuation, meaning it’s “large,” and you must revalue again.

Let’s walk through an example

Consider this scenario:

- V0 (5/31) = 100,000

- C1 (6/12) = 15,000

- V1 = 102,000

- C2 (6/21) = 5,000

- V2 = 118,000

- VE (6/30) = 125,000

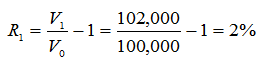

“Large” is 10%, so the first flow (15,000) is “large.” We revalue and derive the return for the first period:

Our next flow (5,000) is “small,” meaning we don’t have to revalue. There are no other flows, so we need only calculate the return for the period from 6/12 to 6/30. We will use Modified Dietz to calculate this subperiod return.

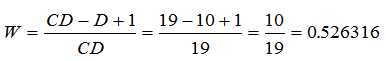

We need to come up with a weighting factor. There are 19 calendar days (“CD”) in the period between 6/12 and 6/30), and the flow occurred on the 10th day (D) of this period. We will use the form of the weighting factor that treats the flow as a start-of-day event:

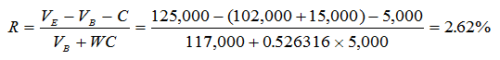

We can now solve for this second period’s return:

And so, we have two subperiod returns (2% and 2.62%). We have to link them to derive our monthly return:

![]()

That wasn’t difficult, but it can become quite complicated.

Revaluing for large cash flows: an endless stream of scenarios to prepare for

These were three relatively simple examples. But surely you can come up with many others that you’d need to be prepared for. For example:

- Large flow

- Small flow

- Large flow.

Here, you’d revalue for the first flow and third flows, and calculate the intermediate period using Modified Dietz/BAI.

But the possibilities are endless; e.g.,

- Small, large, small

- Large, small, small, large

- Small, large, small, large

- Small, large, large, small

Can you see why I think that this approach can be more challenging? Granted, if you revalue for all flows, then regardless of the flow’s size, you’ll need to reprice securities, and ensure that the positions are fully reconciled; otherwise, your data could be inaccurate, meaning your return will be, too.

How does your system revalue for large cash flows?

Many software packages handle the revaluation for their clients. But how do they do this? You may want to ask.

Any thoughts?