We are and have been in the “information age” for some time, but we’re arguably still struggling with it. There have been massive reports about the massive amount of information we’re subjected to on a daily basis. Many (probably all of us) are in the information generating business, and can probably improve what we’re doing. Here are some of my thoughts on keys to providing the right performance information.

1. Don’t assume everyone needs or wants the same information

While it is probably not possible to tailor all reports to meet the needs of everyone you serve, having the ability to customize information is ideal. Today, many performance measurement systems provide nifty tools that will allow end users to design their screens and reports the way they want to see them; such flexibility is becoming almost standard. When creating reports, we should ideally ensure that the information that is provided is done so in as best a manner as possible. It is not uncommon to find many investment professionals receiving pages and pages of reports that they rarely look at; is it because the information has no value to them?

Conduct a periodic report review to ensure that the reports you provide are really necessary and that they are meeting your users’ needs.

2. Resist providing inaccurate information

Ensure you have the proper controls in place to check your data and the results your system produces.

Avoid providing returns that you know or suspect are in error. How can this occur? Some products (e.g., variable annuities) frequently lack the requisite transaction details to calculate correct returns; but because of pressure to avoid showing an “n/a” on reports, returns are provided, even though they’re most likely wrong. This makes no sense to me and should be avoided.

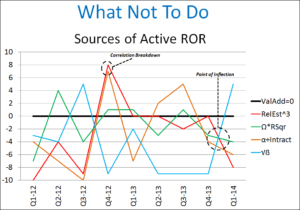

3. Make sure your graphics are readable

At this month’s Performance Measurement, Attribution & Risk (PMAR) conference in Philadelphia, Neil Riddles presented an example of a report that is a bit overdone.

Charting is great, and there are tremendous tools available to create, display, and report information graphically. But having meaningful charts is important. Make sure what you produce has value and is understandable.

4. Avoid providing too much information

A frequently used abbreviation is “TMI”: too much information. Here’s a brief story for which I believe the moral could be, too much information:

A husband and wife are sitting at their kitchen table, eating breakfast; the husband, reading his paper. The wife asks, “if I die, will you remarry?” The husband briefly puts his paper down, looks at his wife, and returns to his reading without saying a word. She asks again “if I die, will you remarry?”

He puts the paper down and asks, “must we talk about this now?” She responds, “yes; it’s really bothering me; I want to know!”

He says “well, marriage has been a very good experience for me, so I think, yes, I will remarry.” He returns to his paper.

She continues “will you sit at this table with her, eating breakfast, sitting in your chair, as you do now?” He again asks “must we talk about this now?”

She demands “yes, it’s important to me to know!” He responds “well, I’d think we would, yes.”

She then asks “and will you sleep with her in our bed upstairs?” He responds “Yes, I’m sure we will.”

She asks “will you let her use my golf clubs?” He responds “of course not; she’s left handed.”

5. Ensure information is timely

I occasionally am not able to read my daily copy of The Wall Street Journal. Once a day passes, there’s little value in going back in. One of our clients calculates daily rates of return, but because of time zone and other challenges, the returns are not available until T+3; to me, this makes the returns virtually useless. While I am definitely not a fan of “real time” rates of return, I would expect that daily means that I’m getting returns for the prior trade day, not three days in the past.

Information often has value if it’s “actionable.” Delays make the ability to take action very difficult.

Asset managers are often under pressure to provide returns prior to reconciliation being completed; I don’t think there’s necessarily anything wrong with this, provided the report is marked “preliminary, subject to change,” so that recipients understand that the information may change.

——————-

Have other ideas on making information delivery better? Please let me know!