Several years ago I coined the “3 Cs of Performance Measurement“: Confusion, Change, and Controversy. The GIPS(R) standards are all three, and today’s post will touch on the “confusion” part, specifically the seven most confusing things about the GIPS® standards.

Confusing things about the GIPS standards

1. Discretion

In my view, “discretion” deserves the top spot of most confusing things about the GIPS standards. The Standards require that all actual (a real account), fee paying (they pay an advisory fee), discretionary (standby) accounts be included in at least one composite. What do we mean by “discretion”? It doesn’t mean “legal discretion.” However, since many firms interpret the term to mean the “legal” reference, I’ve advocated for years that the term be qualified (e.g., “GIPS discretion”), but to no avail. An alternative term would work better, but we’re stuck with “discretion.” And so, what do we mean by it? In “GIPS speak,” it means accounts that have not imposed requirements or restrictions that would cause their account to not be representative of the strategy. Accounts that have such requirements or restrictions that cause their account to not be representative of the strategy are non-discretionary. These would be excluded from the composite. My favorite example is “no sin stocks.” Let’s say you have a client that says “please avoid alcohol, tobacco and gambling.” (I don’t think they mean you, the investor; they just don’t to own shares in any companies that offer these sinful pastimes) Would this restriction cause their account to be non-representative? Well, if you typically don’t invest in these securities, then perhaps this isn’t going to be an issue. However, if you like to invest in sinful stock companies, because there’s money to be made there, and the client’s prohibition is such that their account will be quite different from your non-restrictive accounts, then perhaps you should label the account “non-discretionary,” and simply exclude it from the composite!

2. Minimum Account Size

To me, this is the second most confusing thing about the GIPS standards, although it often isn’t recognized as being confusing. Perhaps this is because we’ve tended to take this required disclosure almost for granted. But it’s important to understand what it actually means. Just about everyone involved with the Standards originally understood the minimum to be the level below which you wouldn’t make a product available to a prospect. But that’s not what GIPS means by the minimum. It’s the level below which you’re not able to fully implement the strategy. This means you could actually offer it to prospects below the minimum (even though you won’t be able to fully implement the strategy). It also means that you might have a higher limit below which you wouldn’t offer the strategy. For example, your marketing minimum might be $10 million, although your investment minimum might be $500,000. In this case, you’d be wise to not even reference a minimum, since you’ll never have any clients that fall below it. (I hope I didn’t just confuse anyone.)

Note: the Standards have the following recommendation regarding the minimum: ¶ I.3.B.1 “If the firm sets a minimum asset level for portfolios to be included in a composite, the firm should not present a compliant presentation of the composite to a prospective client known not to meet the composite’s minimum asset level.”

3. Large vs. significant cash flows

This is ranked #3 on our list of most confusing things about the GIPS standards because it comes up so often during our verifications. The terms are almost synonymous, right? That is, something that is large can also be thought of as being significant. But for GIPS purposes, the terms mean two very different things: Large cash flows refer to situations where you revalue a portfolio. The Standards now require firms to revalue their portfolios for “large cash flows.” This is done to improve the accuracy of the returns. We know that Modified Dietz and Modified BAI are approximations to the exact time-weighted return. However, their accuracy diminishes as the size of the flows increase. And so, to reduce the errors, firms must establish a level to revalue their portfolios. Most firms seem to pick 10%, although we’ve seen lower thresholds. And, of course, many firms revalue daily, so “large” would therefore not even apply, since they’ll be revaluing for all flows. Significant cash flows refer to the option for firms to temporarily remove accounts from their composite when sizable (significant) flows occur. The reason is because the firm may require several days or longer to invest (or come up with) the money. If the account remains in the composite, its return may look quite different from that of the others, and so to avoid any problems, firms may optionally remove the account. There are specific rules regarding the removal, but it’s an option many firms take advantage of. If you invest in a highly liquid market, where you can invest new money quite quickly, then you probably should avoid using this option. However, if the market isn’t very liquid, or if you typically take awhile to invest client monies, then taking the account out while you’re doing this would probably be a wise move. Note that an alternative to the significant cash flow option is to use a temporary account. Sadly, this option is often difficult to implement; very few of our clients use temporary accounts. An option not mentioned in the Standards would be to flag new cash as “non-discretionary,” until you’re able to invest it. This is analogous to putting the money into a temporary account, but might be easier to handle.

4. Composite construction

Composites are at the core of the Standards; without them, there would be no point in having standards. That might be why there remains confusion about them. First, many firms (and even a few verifiers) falsely believe that compliant firms don’t need to concern themselves with “non-marketed” composites. I challenged one verifier, who frequently advised his clients not to bother with them, and regularly avoided reviewing them, to point out where in the Standards we can find the term “non-marketed.” He couldn’t, because it’s not there. The Standards don’t make a distinction between “marketed” and “non-marketed.” You are still required to go through the process of maintaining composites for strategies you aren’t marketing. Creating composites can be a challenge. Should it be client-driven, where you rush and create new composites as the result of whatever variations on your strategies your clients request, or firm-driven, where you create composites based on your strategies? I vote for the latter; my earlier comments on discretion apply to the former. In our GIPS Workshop and Fundamentals of Performance classes we spend time on this subject. I taught the workshop for the CFA Institute for several years, and there, as well as in our classes, issues regarding composite construction often dominate the discussion. To me, the composite is the key to the Standards; it’s what allows for apple-to-apple presentations. But getting them right is critical.

5. Verification

GIPS recommends that compliant firms undergo verifications; but what do we mean by a “verification”? Verification does not verify a firm’s claim of compliance. Verification is, as per the glossary, “A process by which an independent verifier assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards.” And so, we have (1) composite construction and (2) policies and procedures. While the act of verification doesn’t officially verify a firm’s compliance, I believe most folks interpret the success of a firm in making it through a verification to at least suggest that they are, in fact, compliant. Verification a valuable investment because it provides the asset manager (or, in the case of asset owner compliance, the asset owner) with increased confidence. It also serves as a marketing aid, since the industry generally expects firms claiming compliance to have been verified.

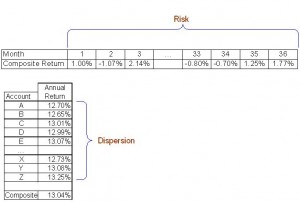

6. Standard deviation

Standard deviation made the list of confusing things about the GIPS standards for a couple reasons. First, because the Standards now require firms to report a 36 month, ex post, annualized standard deviation. Why does that make it confusing? Well, because many compliant firms had previously used standard deviation as their measure of dispersion; now it’s being required for another reason! On a number of occasions I heard questions that made it quite clear that confusion existed (e.g., “must accounts be present for the full time?” relative to the new requirement). Another question: is standard deviation a measure of risk or dispersion? It’s actually both. I created this graphic to describe the two approaches.  The second aspect of confusion regarding GIPS is the use of the asset-weighted form of standard deviation. During the days of the AIMR-PPS, someone concluded that since asset-weighted returns were required, shouldn’t standard deviation be asset-weighted, too? Makes sense, right? Well, not really. How do we interpret the results? The standard method (“equal-weighted”) is easy to interpret. Mathematically, if we both add and subtract it from the average, this range will include roughly two thirds of your distribution. The same can’t be said for the asset-weighted variety; actually, nothing can be said. We recommend against the use of this meaningless statistic.

The second aspect of confusion regarding GIPS is the use of the asset-weighted form of standard deviation. During the days of the AIMR-PPS, someone concluded that since asset-weighted returns were required, shouldn’t standard deviation be asset-weighted, too? Makes sense, right? Well, not really. How do we interpret the results? The standard method (“equal-weighted”) is easy to interpret. Mathematically, if we both add and subtract it from the average, this range will include roughly two thirds of your distribution. The same can’t be said for the asset-weighted variety; actually, nothing can be said. We recommend against the use of this meaningless statistic.

7. Advertising guidelines

With a qualifier like “guidelines,” chances are these aren’t required rules. But, they are! They are required if you have “GIPS” or a reference to the Standards in your advertisement. No reference to GIPS, then no need to follow them. It’s that simple. We offer our verification clients the opportunity to have us review their advertisements, at no additional cost.