First, in the spirit of full disclosure …

The source for this post is one of our GIPS verification clients. They reached out today, alerting me of what they believed was misleading information as reported by Barron’s. After some discussion and a bit of review, I have to agree with them.

When past performance crosses multiple strategies

Barron’s had an interesting article on Eaton Vance’s laddered municipal bond mutual funds, with a focus on Eaton Vance’s TABS 5-to-15-Year Laddered Municipal Bond fund (ticker: EILTX) (“A Smart Strategy for Municipal Bond Investors,” by Andrew Bary (May 27, 2017); it can be found here: https://www.barrons.com/articles/a-smart-strategy-for-municipal-bond-investors-1495858734. ).

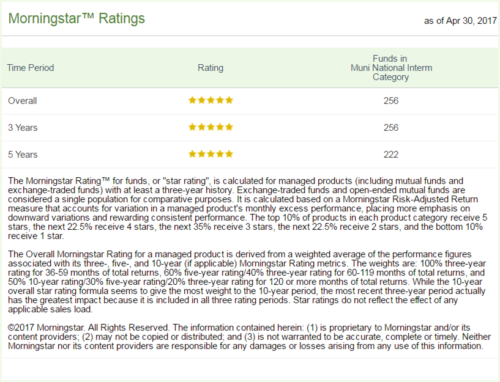

It seems that Morningstar awarded it its coveted 5-star ranking for the past three and five years, as well as “overall” (Source: https://funds.eatonvance.com/tabs-5-to-15-year-laddered-municipal-bond-fund-eiltx.php) for the “Muni National Interim Category”:

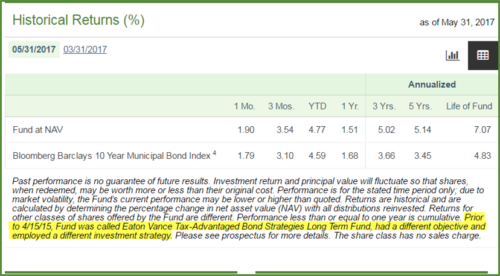

While I’d normally be inclined to congratulate Eaton Vance on this achievement, I am unable to do so as a result of some details they shared (source: https://funds.eatonvance.com/tabs-5-to-15-year-laddered-municipal-bond-fund-eiltx.php):

As you can see, prior to 4/15/2015, this fund (a) went by a different name (Eaton Vance Tax-Advantaged Bond Strategies Long Term Fund) with (b) had a different strategy: which wasn’t, by the way, “interim.”

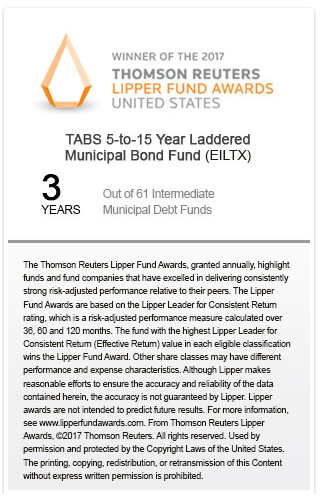

Not just Morningstar!

Lipper, too, ranked this fund high for the three-year period.

Source: https://funds.eatonvance.com/tabs-5-to-15-year-laddered-municipal-bond-fund-eiltx.php.

Barron’s singles out Eaton Vance for their past performance

The Barron’s article applauded Eaton Vance. The article begins: “The bond market offers investors little in the way of yield these days, but Eaton Vance has found a way to offer a little more. The firm’s so-called laddered municipal-bond portfolios, which invest in high-quality munis with maturities of one to 20 years, are proving popular with investors, helped by their decent returns and favorable tax treatment.”

It also references Morningstar’s glowing endorsement: “Eaton Vance TABS 5-to-15-Year ranked in the top 1% of funds in its category over the past three and five years, with total annualized returns of about 5%, according to Morningstar.”

But, there’s a HUGE problem with the past performance!

How does one rank this fund for three years and five years, not to mention “overall,” within the “interim category,” when for most of the period the fund was in a long-term and quite different strategy?

While “past performance is no indication of future results,” we do expect it to represent the strategy being marketed. In this case, it does not.

WWGS: What would GIPS say?

You may be familiar with the “WWJD” abbreviation, that was quite popular at one time: What Would Jesus Do? Well, I thought we’d “twist” it a bit, and ask, what “would GIPS® (Global Investment Performance Standards) say?”

Within GIPS, you’re permitted to change a composite’s strategy. However, if that change is significant, then we expect you to start a new composite.

Apparently the U.S. Securities & Exchange Commission (SEC) permits funds to not only make fairly drastic changes in their names but also in their strategies.

Who’s at fault?

My client contacted me because they’ve been inundated with calls from investors who wanted to know about the difference in Eaton Vance’s performance and their own. This is understandable. And, what was quite surprising was what our client discovered when they did some digging. But, who can we lay the blame on?

Can we fault Morningstar and Lipper? ABSOLUTELY! How can they not have taken this shift in strategy into consideration?

Why would they not have simply discontinued the monitoring of the prior fund, as of 4/15/15, and started with the monitoring of the new one on 4/15/15, meaning they’d be ineligible for the three-year and five-year rankings?

Past performance is important, but correctly categorizing it is critical.

How about Barron’s? Again, YES!

Come on, how do you showcase a fund without taking into consideration the shift in strategies. Plus, the article didn’t even mention this.

And Eaton Vance? Well, yes!

Of course, on 4/15/2015, when they changed the strategy and fund name, they had no way of knowing what the next several months would bring them, but it’s clear that they’ve taken advantage of the Morningstar 5-star ranking. I’m not aware of any evidence to show that they communicated to Morningstar asking that this ranking not be applied, although it covers a period that is quite different than the category.

But, Eaton Vance did disclose the changes! And yes, they did! However, is the footnote sufficient? It may be that Morningstar, Lipper, and Barron’s failed to notice.

Peer group comparison is fine, up to a point

A frequently used benchmark is peer groups. One of their shortcomings is their “questionable makeup.”

Morningstar and Lipper create peer groups for mutual funds; such groupings provide valuable information. However, we would expect that they’d have a degree of integrity to ensure that for the full period in which a fund or manager is included, that they’re, in fact, managing to the strategy of the peer group.

Past Performance can be a Precious Thing

When marketing one’s performance, the longer the period is usually the better. And, to have three and five year performance is quite important. And so, we might understand why Eaton Vance would take advantage of the SEC’s flexible rules to tack on the performance of a new strategy to an old one. To wait for a full three and five years when you’ve already got a longer history for a strategy you’ve decided to discontinue? Why not?

Disappointing and disturbing

I find this all to be quite disappointing and disturbing. What say you?