I’m in Hong Kong this week, teaching both our Fundamentals of Performance and Performance Attribution classes. While teaching the risk section of Fundamentals, I was explaining the characteristics of Value at Risk (VaR), and how, when one defines the confidence level (e.g., 95%), this is only for the area to the lower level, as derived from the method employed. Since we can’t have 100% confidence, the remainder (in the case of 95%, 5%) is the part on the other side of this limit. And, this is the approximate percentage of time that we’ll breech the limit. In reality, given the weakness of our assumptions, the breech occurs more often.

But putting that aside, when losses beyond this limit occur, they can be huge, as witnessed in 2008.

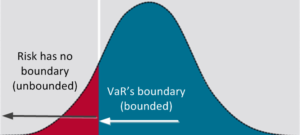

And while speaking, it occurred to me that Value at Risk is bounded, while risk isn’t. I think that’s an important point to recall. Too often folks hear the figure that’s stated with the VaR report (e.g., $10 million) and assume that’s the most they can lose, but that’s totally and unfortunately incorrect.

Despite the frustration that arose from VaR’s alleged failure to properly assess the risks leading to ’08, it remains a popular risk method, and should most likely continue to be employed. But knowing its limitations is essential.