At the CIPM Expert Level, the topic of “performance triangles” is covered, and there is one specific Learning Outcome Statement on the subject:

Demonstrate the use of performance triangles vs. benchmarks in assessing a manager’s track record

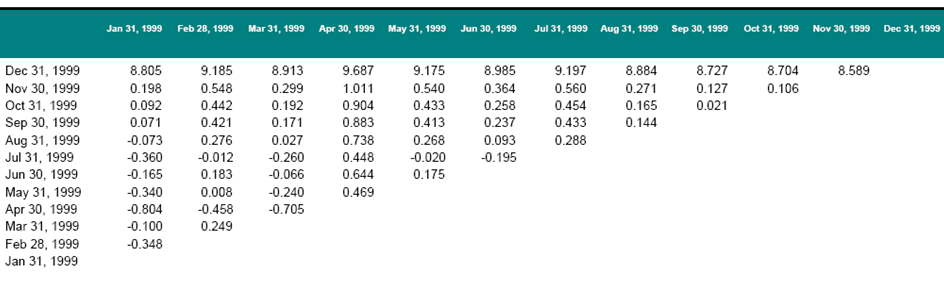

Having said that, the curriculum does not give much background, and it’s not uncommon that students in our prep classes have questions on this subject. Most have never seen a performance triangle (sample pictured above) prior to enrolling in the CIPM Program. Thus, I thought I’d devote a post to this subject.

Performance triangles are covered in the performance appraisal part of the curriculum. Remember that performance appraisal is the process of trying to evaluate manager skill. Thus, performance triangles are designed to be a report tool to assess manager returns. Recall also that with performance appraisal, we define skill as returns that exhibit magnitude and consistency over time.

Performance reports tend to focus on single period results (e.g., historical annual returns, or monthly returns or quarterly returns, etc.). Occasionally, reports may show cumulative periods in addition to the single period returns (e.g., latest year, latest 3 years, latest 5 years, inception to date), but the end date of those periods is the same. Thus if one wants to view single period returns and cumulative returns through a different date, a different report must be run.

A simplistic approach to evaluating a manager is to look at his/her returns (or excess returns) and conclude the manager has skill if those returns are generally positive.

A more comprehensive approach is to analyze the pattern of returns over time… the performance triangle is a tool for this purpose.

The performance triangle is a multi-period performance report that gives a view into how single period returns affect cumulative (i.e., compound period) returns over time.

The construction of the triangle is as follows:

- On the horizontal axis are a set of period end dates, in ascending order from left to right. These are “from dates.”

- On the vertical axis are the same set of period end dates, in descending order from top to bottom. These are “to dates.”

- In the “report grid” are the cumulative returns for each period (based on the from and to dates). The data in the grid naturally form a triangle based on which periods have returns (grid will be the “upper left triangle of the grid; the bottom right is naturally blank.

- The hypotenuse of the triangle has all of the single period returns. The rest of the grid is cumulative performance from the “from date” (on the horizontal axis) through the “to date” (on the vertical axis).

Thus, with a single report, a reader can glean things such as

- how the manager’s performance is in single periods and in various cumulative periods through different ending dates

- trends in the manager’s results

- whether the manager’s positive or negative performance cumulatively is due to consistent good (or bad) results as opposed to extreme good (or bad) returns

- recovery time after losing returns, as well as the amount of time it took to lose the value gained by positive returns

I hope this background helps explain the report a bit… happy studying!