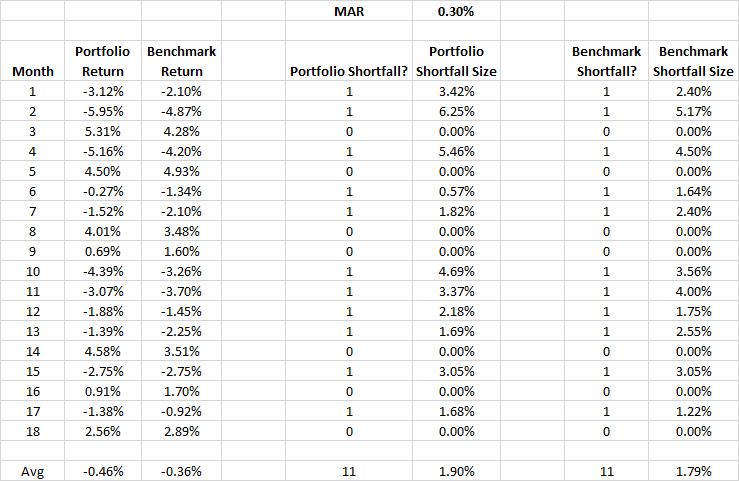

An Expert Level CIPM candidate recently emailed me regarding a question on the sample exam found on the CFA Institute website in the CIPM Program area at this link. Specifically they asked a question regarding question #12, which asks about the shortfall risk of the portfolio compared to the shortfall risk of the benchmark.

The first thing I would point out to candidates is that this question is probably obsolete, as the 2015 curriculum does not cover shortfall risk at the Expert Level or the Principles Level. Shortfall risk was covered in previous years, but that reading content has been removed. (Note that the date of the copyright on the CFA Institute’s sample exam is 2009.)

That said, the correct answer to the question is that the shortfall risk of the portfolio and the benchmark are the same.

The trick to this question is to know that shortfall risk only measures the frequency of losing returns. Shortfall risk does not consider the size of losing returns – that is done by other statistics such as downside potential and downside deviation (both of which *are* covered in the 2015 curriculum).

In the data for this question, shown in the picture below, both the portfolio and the benchmark have 11 losing periods vs. the required target return (MAR, or minimal acceptable return) of 0.30%.

Happy studying!