by admin | Dec 28, 2024 | GIPS, Global Investment Performance Standards, risk, risk-adjusted return, Sharpe ratio, Standard Deviation

Standard deviation is a much misunderstood measure, in spite of its common use. First, is it a risk measure? It depends on who you ask. It’s evident that Nobel Laureate Bill Sharpe considers it to be one, since it serves this purpose in his eponymous...

by admin | Oct 19, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, kurtosis, MPT, Omega ratio, performance measurement, post MPT, risk measurement, Sharpe ratio, skewness, Standard Deviation, value at risk

Last night, my hometown team, the Los Angeles Dodgers, was defeated by the St. Louis Cardinals in the National League Championship series. The Cardinals will go on to the World Series for a chance at what could be their 20th world championship… while the...

by admin | Feb 6, 2012 | Sharpe ratio

Bill Sharpe read my recent blog post on addressing negative Sharpe ratios, and offered the following:Your blog post seems fine.About the only alternative I can offer is this:The (original) Sharpe ratio in effect compares two alternative combinations of treasury...

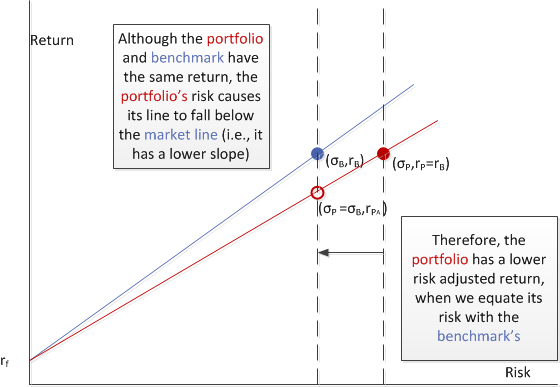

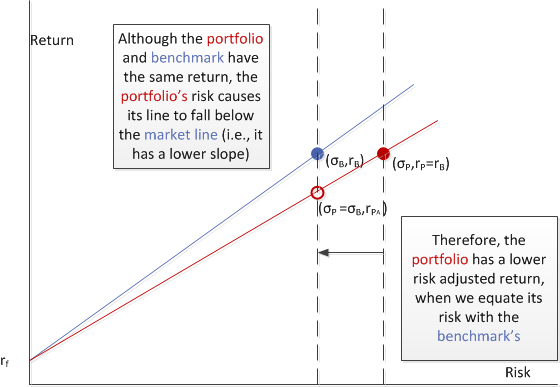

by admin | Feb 3, 2012 | M-squared, Modigliani, risk, risk-adjusted return, Sharpe ratio

In TSG’s January newsletter, I expanded upon a recent blog post where I introduced a couple graphics in an attempt to “make sense out of” negative Sharpe ratios. Two pillars of the investment performance community, Carl Bacon and Steve Campisi,...

by admin | Jan 25, 2012 | GIPS, Global Investment Performance Standards, risk, Sharpe ratio, Standard Deviation

The Global Investment Performance Standards (GIPS(R)) now require compliant firms to include the 3-year, annualized standard deviation for the composite and its benchmark. And while this was a somewhat controversial move, it’s here, so we live with it. But, why...

by TSG | Jan 15, 2012 | Performance Perspectives Newsletter, Sharpe ratio

VOLUME 9 – ISSUE 5 January 2012 Download PDF...