I have been a fan of "synchronicity" for some time; it's essentially the belief that there are no such thing as coincidences; instead, things happen for a reason. Yesterday, I posted about Napoleon Hill. And earlier today I discovered this on Facebook: It was posted...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Inspiration

A word on education, from Napoleon Hill

Napoleon Hill wrote the classic, Think & Grow Rich. I am reading it for the umpteenth time, and came across the following which I think is important to consider:Successful men*, in all callings, never stop acquiring specialized knowledge related to their major...

Mission Accomplished!

My postings slowed down this week, because I was preparing for my doctoral dissertation defense, which occurred yesterday (despite the horrid weather we were having). I am pleased to announce that I was successful. I have wanted to achieve this goal for nearly 30...

Looking for a date? How about three?

We were recently contacted regarding the appropriate date to use for a fund's inception. This caused me to reflect a bit, and I thought I'd touch on this briefly. There are essentially three dates you may want to concern yourself with: Inception Date: this is the date...

“They were simply outplayed”

It's probably not surprising that Sunday's Superbowl is still a topic of discussion. I'm conducting a GIPS(R) (Global Investment Performance Standards) verification this week, and this morning, when I went into the hotel's concierge lounge, I overheard two women who...

That which gets measured, gets improved … or maybe not

I have to thank my lovely daughter-in-law, Monica, for providing this photo to me. Consider this, a "fun" post. I was in the Army for almost five years, and stationed for 39 months with the 25th Infantry Division (Oahu, Hawaii; I was a Field Artillery officer)....

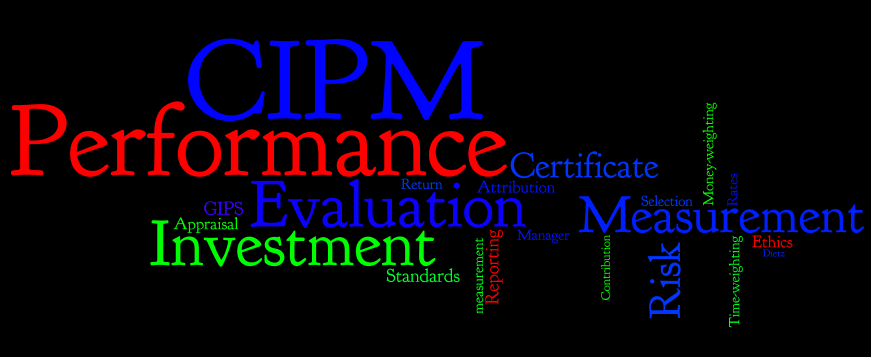

ISN’T IT FINALLY TIME FOR YOU TO TAKE THE CIPM EXAM?

Note: the following comes from this month's newsletters, but I wanted to get it out, given the urgency of registering! The CFA Institute has made a huge commitment in our segment of the industry by creating, maintaining and administering the Certificate in Investment...

Spaulding,…, David Spaulding

This year's Performance Measurement, Attribution & Risk (PMAR) conferences, like last year's, will have a theme. It started as "Casino Royale," but has been broadened to "Secret Agents," or more specifically, "Secret Agents of Performance Measurement." As with...

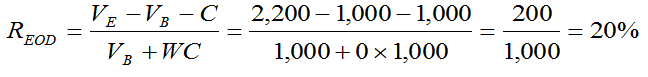

A case for a mixed cash flow treatment policy

Most of those who calculate rates of return have settled on either the end-of-day or start-of-day treatment for cash flows. Some time ago I arrived at the belief that a mixed treatment is better: Inflows: start-of-day Outflows: end-of-day. While in bed one...

Are big contributors always good to have in your portfolio?

Contribution, aka "absolute attribution," is a commonly used measure of performance. It's simply the return of whatever we're evaluating (securities, sectors, etc.) times its weight. We sum these values up, and they should equal the portfolio's total return, but may...