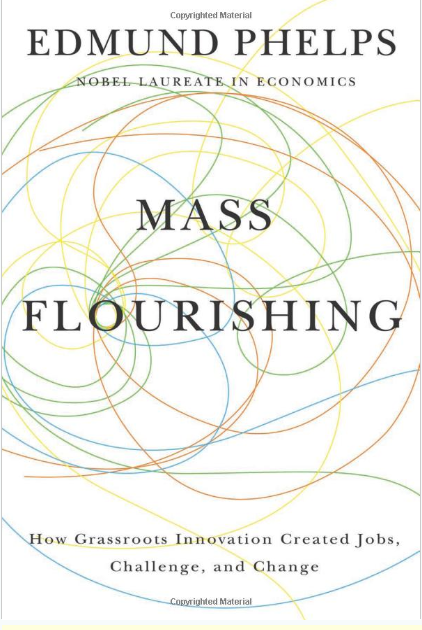

I have begun to read Mass Flourishing, by Edmund Phelps, a Nobel Laureate in Economics. He begins with the following: “Flourishing is the heart of prospering – engagement, meeting challenges, self-expression, and personal growth…A person’s flourishing comes from...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Flourishing as an objective

Buy high and sell low isn’t a recipe for success, but it’s the strategy most investors seem to follow

In this weekend's WSJ, Jason Zweig discusses how investors too often make poor contribution/withdrawal decisions (see "How Investors Leave Billions on the Table").He mentions how Pimco's Total Return fund had a 12-month return (as-of September 30) of -0.74%, that...

“A stunning implication…”

The words in this post's title appear in Nobel Laureate in Economics Leon Lederman's The God Particle. I can't say exactly why, but when I read it those words struck me.A stunning implication.I once read that good writers write one word at a time; I believe Lederman...

If God didn’t want us to lie, He wouldn’t have invented politicians

I've been wanting to use the line in today's heading, and stumbled upon a way (though it may be a stretch). I came up with it recently, and think it's clever (but I'm biased a bit). As a former politician, I am fully aware of the linkage between the art of lying and...

DON’T ONLY “show me the money”

A memorable line from the Tom Cruise/Cuba Gooding movie, Jerry Macguire, is "show me the money," uttered multiple times by Gooding. As a result, it has become a part of our society's broader lexicon. This reinforces the point that we occasionally look more at the...

A webinar like no other … kind of scary!

This Halloween (October 31) at 11:00 AM (EST), John Simpson, Jed Schneider, and I will host our monthly webinar. This month has a theme ... I wonder if you can figure it out? It's titled: We will cover a lot of scary and interesting stuff about performance and risk...

Baseball and material errors

It is rare that people keep track of errors, but baseball, with its love of statistics, does just that: goof during a game and it will usually get recorded. In last night's Detroit Tigers vs. Boston Red Sox game, we were treated to three errors, two by the same...

Timing & GIPS Compliance

There are probably few documents that say as much about timing as the Global Investment Performance Standards (GIPS(r)). But our focus is more limited, and won't address everything that appears.One of the most important questions is when should a manager become...

Timing & Risk Reporting

How long before you report risk measures as part of your performance?Returns can be shown for a day, a few days, a week, a month, a quarter, a year, etc. Risk statistics typically rely upon a series of returns. But how many and which ones?The standard seems to be 36....

A week about timing, starting with returns

It occurred to me that we could spend some focused time on the issue of time (pun intended). Let us begin with rates of return.One of the ironies of performance measurement is that the term "time-weighting" has really nothing to do with the weighting of time; it's a...